On October 9th, Ms. Ellen Zentner, Chief Economist of Morgan Stanley spoke to the Junior Economic Club about the US Economic Outlook during life after COVID-19. Ellen serves on the Treasury Borrowing Advisory Committee (TBAC), the Economic Advisory Panel for the Federal Reserve Bank of New York as well as the American Bankers' Association, and is Chair of SIFMA's Economic Advisory Roundtable. She is a Director of the National Association for Business Economics as well as the NABE Foundation and is a past president of NYABE. Ms. Zentner holds a Bachelor of Business Administration and a Master's Degree in Economics from the University of Colorado.

Ellen Zentner outlined a four scenario approach for forecasting post-COVID life: bullish, base +, base, and bearish outcomes in terms of the virus. It is important to note that the bearish outcome, nicknamed “deep scars”, is dramatically worse than the other three cases. This presentation’s projections align with the base case.

Key forecasts include the following:

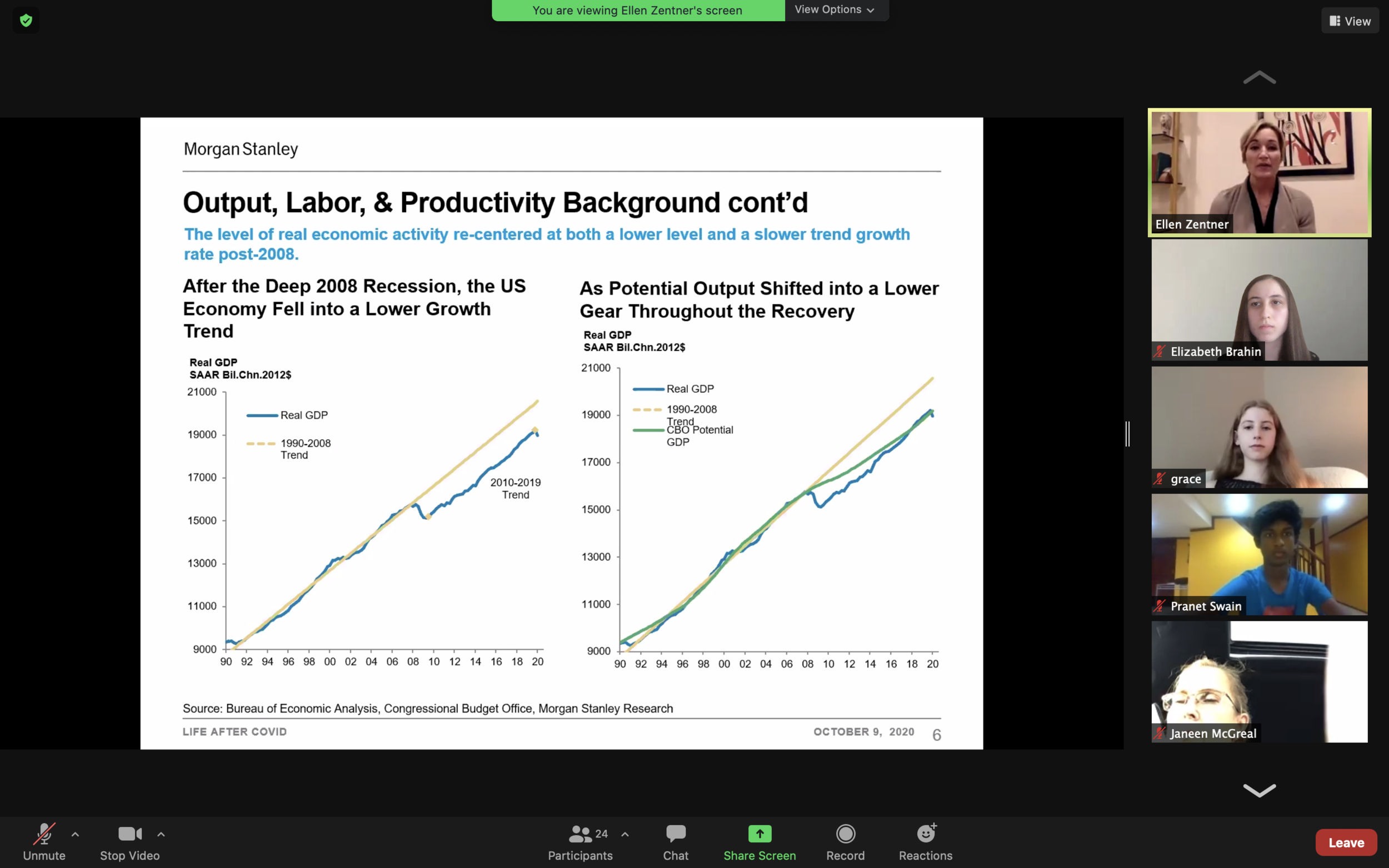

Economic Growth: During the pandemic, productivity growth has stayed anchored around 1%. That said, technological improvements suggest more working from home beyond these times. Ms. Zentner forecasts that women and individuals with disabilities will have more employment opportunities in the future due to the feasibility of work from home. While work from home arrangements are sustainable, she predicts that people will eventually go back to the office due to the culture of innovation fostered by in-person interactions.

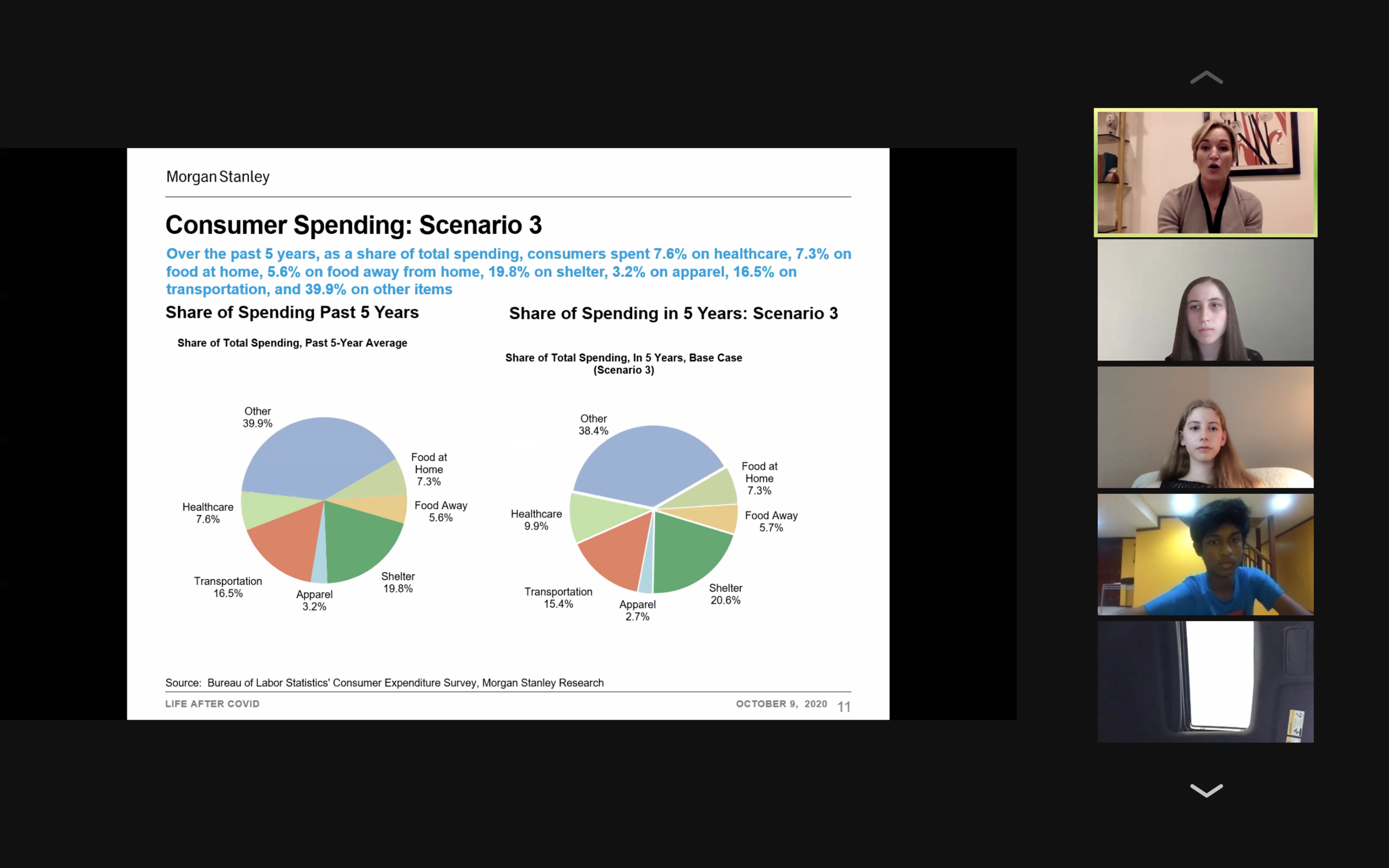

Spending: Consumer spending trends during COVID have shifted to be similar to that of retired individuals. Spending on apparel, transportation, and food away from home decrease while healthcare, housing supplies, and food at home increase. In addition, consumers are likely to move away from multi-family homes in favor of single-family homes in the two more conservative cases.

Savings: Ms. Zentner projects an increase in the savings rate in addition to a permanent increase after the recession ends. This is attributed to the fact that disaster can strike at any time, a harsh lesson learned after this unpredictable year.

Fiscal Policy: In terms of interest rates, the Fed is expected to keep interest rates low, near 0%, over the next 5 years and beyond since they are less worried about keeping inflation in check and more focused on restoring unemployment to pre-pandemic levels.